2024-05-30 10:40:25

Broader Market setup and Looking aheadNifty CMP: 22600

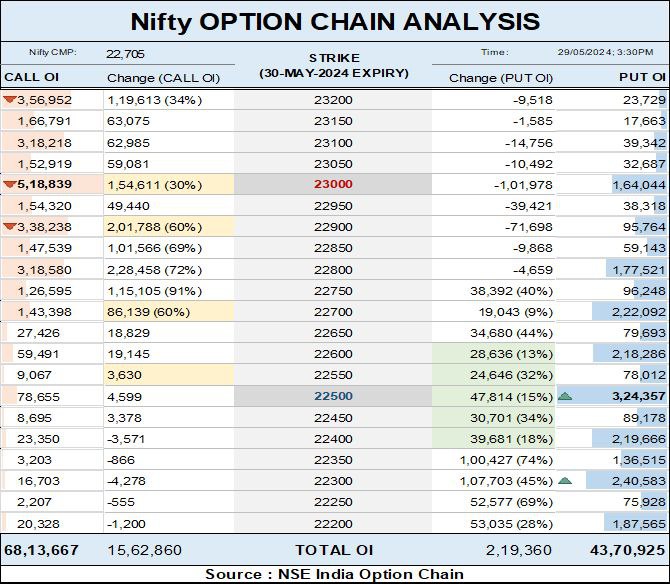

The upcoming announcement of the general election results in India, with vote counting scheduled to commence on June 4, is expected to have significant implications for the market. In the past two years, global markets have faced significant challenges, including geopolitical tensions, rising interest rates, and inflationary pressures. Now, as we approach the announcement of world’s largest democracy’s general election results, the Nifty index appears to be taking a breather. Market participants are closely monitoring the situation to gauge the market's direction post-event. On the global front, interest rate uncertainty from the FED continues as US bond yields have bounced back to near recent highs. We also have the Domestic Budget and US elections panning out in the second half of the year.

#Current Market Analysis-

Nifty has seen an impressive rally of over 37% in the past 1 year (from March’23 lows @ 16828) without any significant (>10%) correction. Nifty is expected to gain further momentum on sustain above 23100. A breakthrough & sustenance of the resistance, accompanied by robust volume, could initiate a fresh rally towards 24000-24500 in the coming weeks or months. Conversely, a failure to breach and sustain this immediate barrier is indicating early signs fatigue. This could potentially push Nifty back to the Bullish support line of defence near 21700 (recent swing support).

The medium-term technical oscillators are also slightly over-stretched on the higher side. In this context, a breach of swing levels of 21700 could be significant ~ It will open the possibility of a more substantial decline. It's also important to note the significant increase in Implied Volatility levels, as reflected by INDIAVIX rising from approximately 10% to 26% in just one month. This spike underscores the need for thorough evaluation of any option strategy, considering not only its Delta and Theta profiles but also its Vega sensitivity.

#Scenarios and Strategies

1. Bull Case Scenario: Nifty breaks above the 23100 resistance level

· Positive setup reinstates above 23100 with a target of 24200-24500

· Having conquered 23100, Dips can be bought into closer to 22200

· Options: Buy naked-Call or Bull-Call Spread (June Series)

2. Bear Case Scenario: Nifty fails to sustain above 23100 & rather fall below the trend support at 21700 (breaks down)

· Hedging is advisable below 23100 ~ failure to cross could lead to a decline towards the major support levels of 21700 and lower

· Positive only above 23100

· Reduce Long positions in high-beta names

· Options: Long Put or initiate Bear-Put Spread (June Series)

We would advise aggression only above the 23100 mark – expect volatility to remain high but only a cross of the mentioned levels will suggest a rather clear trading setupDerivatives Research Desk

Recommendations are for internal circulation only

Disclaimer: https://bit.ly/DisclaimerKSLResearch

16.2K views07:40