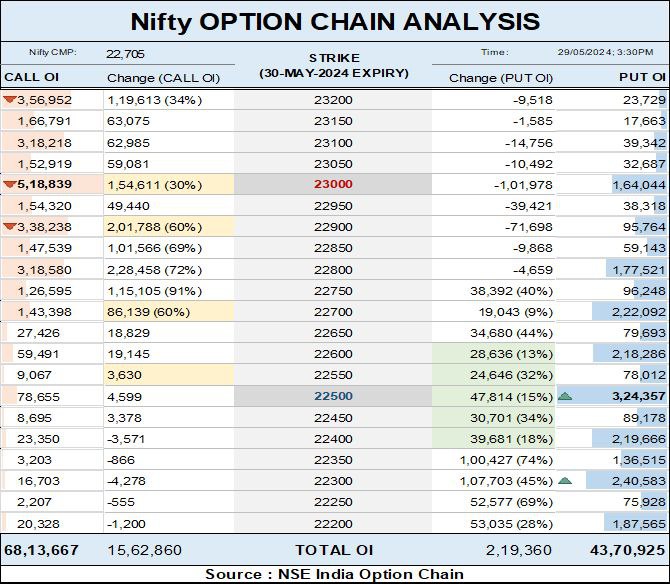

Option Chain Analysis (29-May-2024 ;EOD)The options market indicates that the highest open interest on the call side is at 23000/23500 level, while on the put side, its at 22500/22000. Today's option chain analysis reveals a higher volume of call writing in comparison to put writing, signaling a bearish sentiment in the market.

The Volume Weighted Average Price (VWAP) suggests a trading range for the next day between 22630 and 22890. The Max Pain is seen at 22800 spot with the CE/PE Combined Residual Premium/Pain Value of 1844.98 Crores.

Update on Option Chain Analysis will be shared in the Live market

Disclaimer :https://bit.ly/DisclaimerKSLResearch

Source: www.nseindia.com