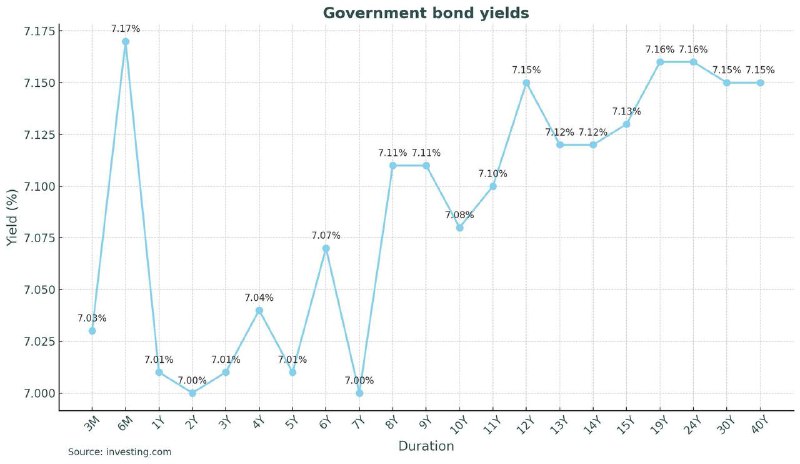

Here are the current yields on Treasury bills (T-bills) and Government bonds (G-Secs). The entire yield curve looks flat.

In other words, the difference between the yield on shorter-maturity bonds and longer-maturity bonds is negligible.

What does this mean? Broadly, you can assume two things:

- Since there's no duration premium i.e., you are not getting a higher yield for investing in longer maturities, you can stick to shorter-duration bonds.

- If you expect interest rates to go down going forward, you can lock in the yields on the longer-duration bonds. If and when the interest rates fall, you stand to make capital gains.

Check this thread on TradingQnA for an explainer on bond basics

https://tradingqna.com/t/basics-of-government-bonds/139217

In case you missed it, you can invest in T-Bills, G-Secs and SDLs on both Kite web and the app. Just click on "Bids" and then "Govt. securities."

Learn more about Government bonds